Buy a house in USA on a temporary visa: renting vs buying

The facts

I have watched multiple youtube videos, listened to the same amount of podcasts and read some blogs. But in my opinion all of them are the same: just guides.

I arrived in the US in 2020. I got the keys of my house 2021. I can tell you how I did it. These are facts.

In these series, I am going to walk you trough my experiences, what works and what does not and how I have protected myself not to have too many issues even if I loose my immigration status.

Please be aware; I am not a financial advisor. Has this worked for me? Yes.

Before you start

There is something really important that you need to do before you even consider buying a house. It is free (despite what some other immigrants have said in other forums) and it is really easy to do.

What is it? Getting a good credit score. Don't worry. If you don't know where to start in this post I explain everything you need to do the get a 750 credit score in one year. For free

Renting vs buying

Every country is completely different in terms of taxes and cost of housing. As I do not do this for the money (yet) I don't want to waste your time with a long post. The first that you need to understand is that you cannot compare rent with mortgage. In my experience this is what you should do instead:

Rent vs Mortgage + Insurance + Property taxes + HOA

Is this clear? Perfect. Now you may be wondering, where can I get those numbers? Let me explain

Renting

In my experience (Michigan) there are two websites where you can check rent prices apartments.com and zillow. This one was easy.

Mortgage

As I don't know where you may be looking for a home so I am going to give you two options again:

- Redfin. It may be not available for you in your area but if it is, I urge you to check it out (not sponsored). It is also ideal if you have a partner. For me, it was the place where my wife would approve/deny all my selections (I am good with numbers, she is the one with a more developed aesthetic sense). Not only that, she found us a fantastic real estate agent (if for whatever reason you are also looking for a house in metro Detroit, please DM on LinkedIn and I will put you in contact with her).

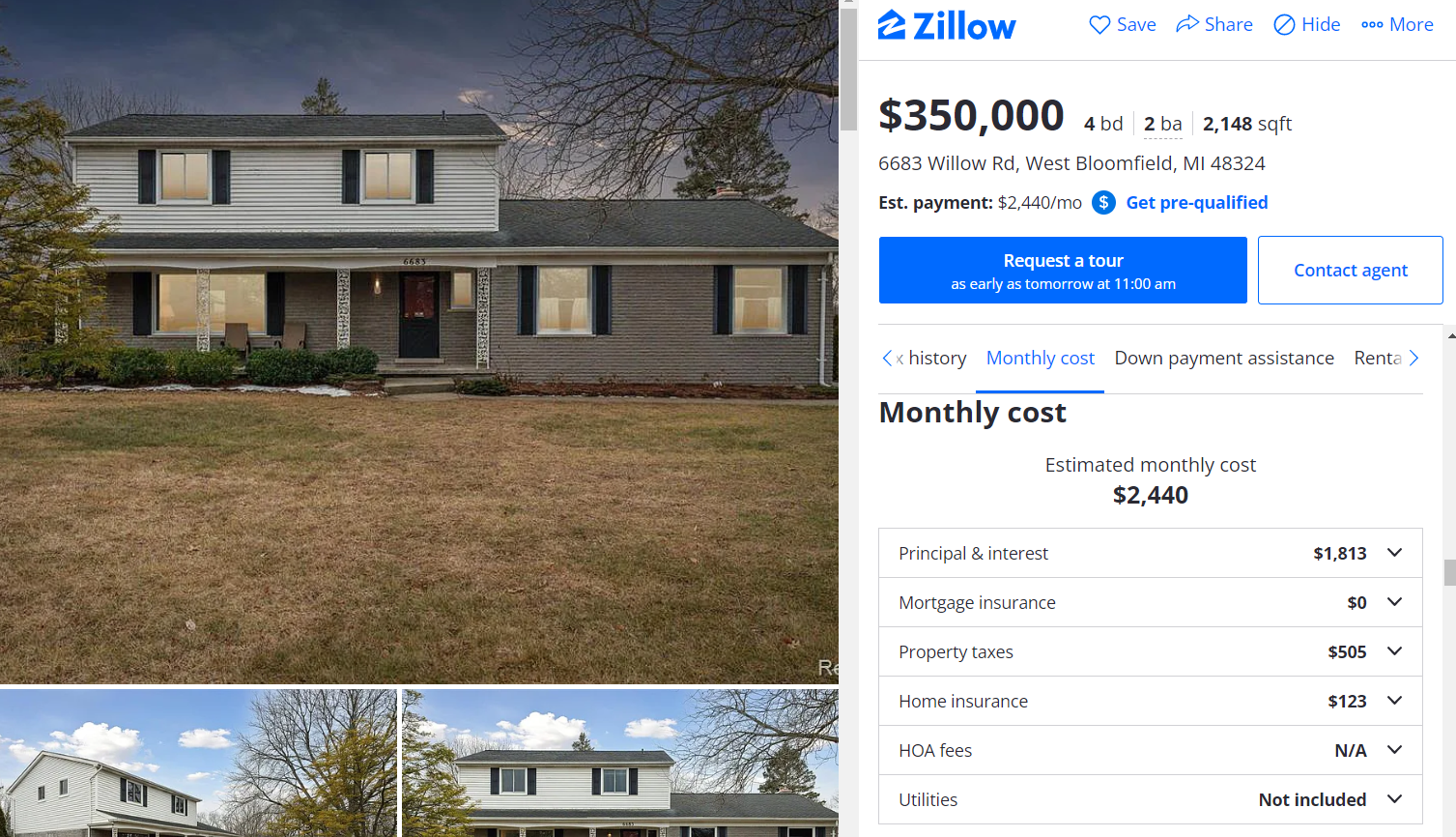

- Zillow. You have to use it. That sold filter is just too good to be missed.

Both of these webs have tools to estimate mortgage payments. Please, please do not use it to estimate property taxes.

Property taxes

This is where things start to get interesting. I know why you may be thinking. Is it not this already included in the webs that you just told me?

Not exactly. Lets put an example.

If we were to take what Zillow tell us (am I the only one that thinks that those photos with artificial light in every window are just weird?), we would be paying in property taxes $505/month in property taxes.

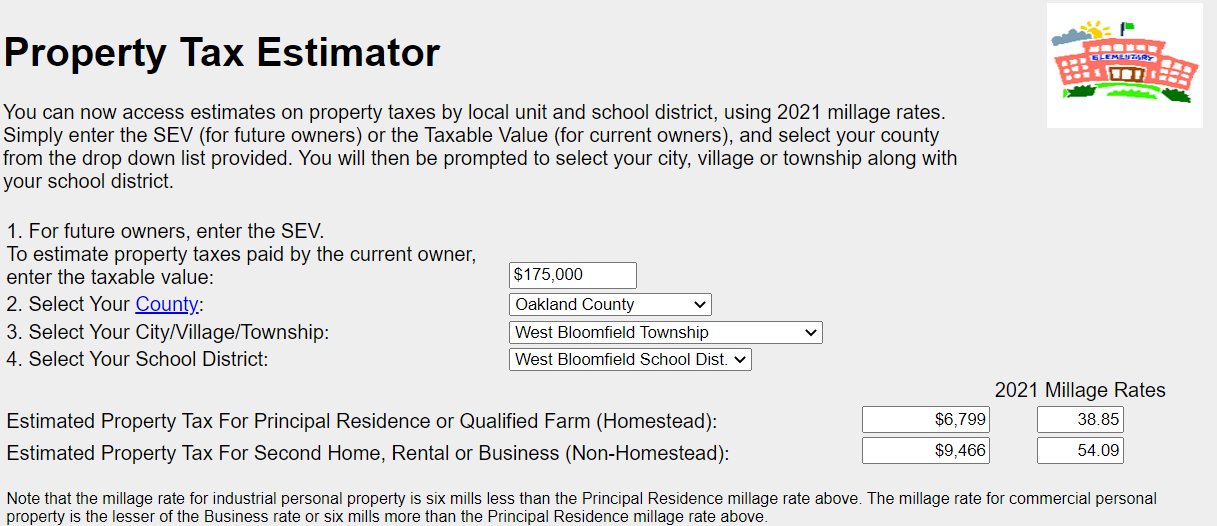

But I am sorry to disappoint you, but that would not be the case. The numbers would be closer to something like this:

In plan words:

- You will pay approx. $566.58/month if you get it as your primary residence

- You will pay approx. $788.83/moth if you decide to rent it out

You may be wondering why this difference even exist. The key is in this sentence:

You are future homeowner and that's why you need to enter SEV (State Equalized Value). And how much is the SEV? Use half of the price that you wil pay as a rule of thumb in Michigan (and therefore the reason why I enter the $175k).

Where did I get all this information? I just googled *property tax estimator Michigan * and accessed the government webpage

TLDR: Do not blindly follow Zillow/Redfin estimated property taxes. Find the property tax estimator for your state and calculate your taxes based on the purchase price

Insurance

There is not a good way to say this. This is a pain that part that I should not mention. This is how I approached this number:

- Use the estimation from Zillow/Redfin whenever at the beginning

- Use the home insurance calculators from sites like progressive on the places where I put an offer

HOA

HOA or Home Owner Association fee. My personal take:

- Just use what Zillow/Redfin tells you

- Do not buy a place with HOAs unless you clearly know where you are getting yourself into (we decided to discard them directly)

What's next

With that I am hoping that you have now a good idea of the monthly fixed cost that buying a house my entail. In the following post. I will explain to you the specific on how I found the cheapest house in one of the best school districts in Michigan.